Latest Posts

View the latest posts in an easy-to-read list format, with filtering options.

View the latest posts in an easy-to-read list format, with filtering options.

Multi-part posts on a particular topic, grouped together in "series" pages.

Look through our blog archive by year / month, or in a massive title list.

02/23/2026 - 3 John is the shortest New Testament letter by word count, yet it gives us a vivid snapshot of ear... Read More

02/21/2026 - After admonishing the church to walk in love, 2 John 7 says, 7 For many deceivers have gone out in... Read More

02/20/2026 - Second and Third John are short letters of instruction from John “the elder.” Both of... Read More

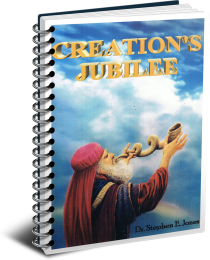

Over 100 books covering a variety of topics

Short, single-page teachings on a topic

Single page teachings by various authors

Monthly newsletter containing ministry updates and long-term teachings

Audio recordings of teachings and discussions on a variety of biblical topics

Vlog recordings with Dr. Jones and video recordings of bible conferences.

Read over 100 books written by Dr. Jones, available to read for free online. Several of the books have also been translated into different languages, and are also available to read for free. The only time you pay is when you purchase a physical version of a book.

View Full Book List

Read a variety of tracts that condense a topic into a short, single page format. These tracts can be read for free online, or physical copies can be purchased in bundles. If you are subscribed to the FFI Newsletter, you will receive new tracts when they are released.

View Full Tract ListRead articles written by Dr. Stephen Jones and a variety of other authors.

View Full Article ListThe FFI Newsletter is a monthly newsletter written by Dr. Stephen Jones that gets posted online and mailed physically to newsletter subscribers. These include long-term teachings and ministry updates when available.

View Full FFI ListListen to audio recordings of teachings from Dr. Jones and discussions on a variety of biblical topics, available for free online.

View Full Audio ListWatch video recordings of conferences, as well as a variety of interviews and vlogs from Dr. Jones.

View Full Video ListFirst time here, and don't know where to start? No worries, we got you covered.

We have taken the five ministry gifts (Evangelists, Pastors, Teachers, Prophets, and Apostles) as an outline for the courses of Bible study in this School.

Our purpose is to equip those who are ministering with a knowledge of the Word, so that each will be more effective in fulfilling his or her calling.

Learn MoreIndia's trade deficit increased quite a bit in April, as Indians took advantage of the low gold prices. Gold imports increased from $3.1 billion in March to $7.5 billion in April.

I worked that out on the calculator. The INCREASE from March is $4.5 billion, which, at a price of $1450/oz, comes out to about 97 tons of gold. That was not the total amount that India imported. That was just the increase from March figures. And keep in mind that these were imports of physical gold, not theoretical paper entries on a computer.

http://www.zerohedge.com/news/2013-05-13/india-trade-deficit-deteriorates-gold-imports-soar-138

India's economic boogeyman, the monthly trade deficit, continues to rear its ugly head, this and every time, driven be the country's insatiable desire for gold which is so powerful, the country took full advantage of the plunge in gold prices, and saw business imports of gold soar by 138% y/y [year to year] in April, forcing the trade deficit to hit a 3 month high of $17.8 billion as more fiat left the country in return for bringing in more of the "barbarous relic." Gold imports more than doubled on both a Y/Y and sequential basis, with gold accounting for $7.5 billion, or 18% of total imports, compared to $3.1 billion in March....

Gold imports in April were $7.5 billion, compared to $3.1 billion in March. This was driven by the sharp fall in gold prices during the month.

It is becoming increasingly clear that the Fed's policy of currency debasement, along with the ongoing manipulative price slam through their banking cohorts, has created a whole new economic reality. We are fast moving toward the day when we will reach the end of the silver and gold supply that is available at these low prices. As long as any dealer is willing to sell the physical metal at a price that is linked to the paper spot price, it is probably going to be a bargain price compared to the future.

The Fed has tried hard to paint gold as "the barbarous relic" for many years. Back in the old Roman days, anyone outside of their empire was called a "barbarian," even though many of those so-called "barbarians" had a higher civilization and were better educated than the Romans themselves. The term "barbarian" was used largely as an ethnic slur. The Fed decided to use it to describe gold, hoping that it would make people despise gold, thus keeping down the demand for it.

But it appears that India has not been influenced by the propaganda. Neither has China. It appears that the West has decided to have a going-out-of-business sale on gold and silver and is slashing prices. Everything must go! The Asian market is flocking to the Fed's garage sale.

In the end, the West will have a lot of paper, and the East will have a lot of gold and silver. Who do you think will have the real wealth in the end? It has been said that in the end paper money always returns to its intrinsic value--zero.

Dr. Stephen Jones has been writing blog posts since 2005 on a variety of topics from Bible Studies to World News, and he has been writing books since 1992. Dr. Jones' most important writings came after God brought him back into the full-time ministry in 1991. It is here that all his earlier years of searching the Scriptures began to come into clear focus. He combines a knowledge of the Old and New Testaments with a personal revelation of God that began and developed during the "wilderness" period of his life, which he often refers to as God's True Bible College... Read More

Subscribe via email or RSS feed to stay up to date on the latest posts. You can unsubscribe anytime.

There is a lot of content on this site, and that can be overwhelming, so we've written up a guide to help get you started!

Start HereIf you want to receive updates from us, signup below.

We are only able to do what we do because of your support. If you feel led to support this ministry, we deeply appreciate it